Nearly 3,000 attendees from dozens of the wine-producing countries of the world tuned in on January 18th to hear from Rob McMillan, EVP & Wine Division Founder, Crimson Wine Group CEO Jennifer Locke, industry innovator Paul Mabray, and Enolytics SVP of Professional Services Ed Thralls as they discussed the trends and findings identified in SVB’s 23rd annual State of the US Wine Report.

Watch the Replay: SVB State of the Wine Industry - 2024 Virtual Event (youtube.com)

Read the Report Here: State of the US Wine Industry Report 2024 | Silicon Valley Bank (svb.com)

Recognizing the Need for Change

The key findings indicate that the alcohol beverage market across the board is in a period of change, driven by evolving consumer dynamics, including the aging of older wine-focused boomers, who are being replaced by a new set of primary consumers who drink across categories, drink less wine, and consume less alcohol.

“With the current messaging about alcohol as it relates to health and wellness, premium wine is well suited to meet the prevailing guidance around benefits and moderation,” said Jennifer. “We don’t have to reinvent what we are making; we have to retell our story and tell it collectively.”

Premium wineries experienced mixed success during the past year. The value of premium wine is still growing, but we anticipate volume sales will finish lower this year. The industry will need to find collaborative solutions to link wine attributes with the segmented values of newer consumers to increase demand while at the same time finding efficiencies in sales, marketing, and production to retain margins.

Minor headwinds contributed to the mixed outcomes at premium wineries.

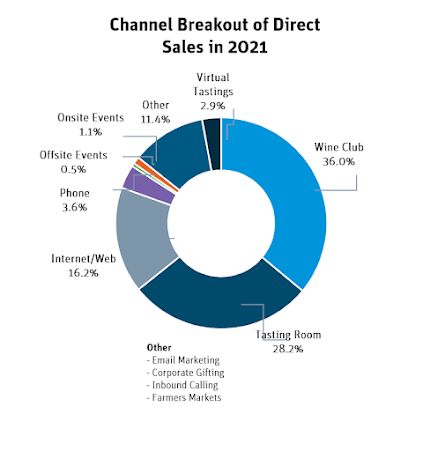

Direct-to-consumer volume sales were lower in 2023. Tasting room visitation dropped for the second straight year leading to lower premium sales through nine months in 2023. However, strong 2023 holiday sales should lead to positive growth in value at year-end.

Consumer demand for the total wine category continues to decline.

As reported over the last several years, in addition to wine, U.S. consumers have been drinking across categories such as ready-to-drink (RTD) options, spirits, beer, and cannabis or have been abstaining altogether.

There is an oversupply of planted vineyards, given current sales volumes.

Conditions are ripe for overproduction, which may lead to inventory excess in more price segments, discounting, and eventually price reductions. Pressure starting from the grower will create inventory bulges and drive higher-than-needed inventory turns in 2024.

.jpg)