We all became unusually preoccupied in the U.S.starting somewhere around March 15th, 2020. I don't know about you, but the picture above was how I felt at that point in time. Since then, all of our thinking and behavior has evolved in a myriad of ways, and some of that evolution is permanent.

I'm hopeful we are nearing the end of this queird social, economic, and health experiment. After getting sucked out of our realities by the COVID tornado, I think we are finally on the glide path that will land us in Oz. I know it won't be Kansas anymore when we lift from our comatose fog. It will be something different and probably in Technicolor. But whatever it is, it's going to be better than the last two years!

Anyway, with all the distractions since 2020, I've been remiss in posting this blog. In my defense, I thought this post probably didn't matter given the other issues we were all facing. But the smoke is clearing, the vaccines and boosters are helping, Omicron is waning, so just maybe I'll be able to shake someone's hand again without running for alcohol sanitizer.

To the point of the blog though, top-level the answer to the title question is "more than you expected."

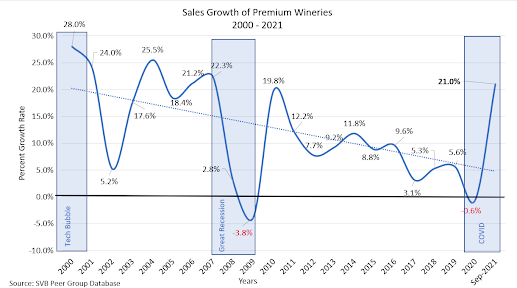

The chart nearby is one I use in the State of the Industry Report and in many of my speeches. It represents a benchmark of performance for the average-sized U.S. winery.

In the chart, the green bars represent gross margin (total sales minus the cost of goods sold, divided by total sales and expressed as a percentage), and the orange line is the pretax profit margin. Pretax profit margin is calculated after deducting interest and all other expenses, except tax. The blue line is the industry sales growth rate. You can back into total operating expenses if you are interested, by adding together the pretax profit margin and the gross margin, then subtracting the sum from 100%.

COVID Business Results

At the time when shelter-in-place orders were issued, premium wineries had less access to off-premise channels. The direct-to-consumer channel was the best option to make up for lost sales so many owners decided the best way to get visibility was to discount wine or give away free shipping to incentivize sales.

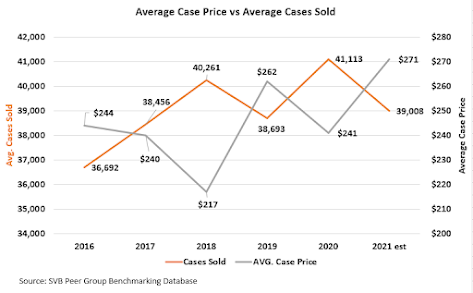

The strategy worked as more cases were sold in 2020 to make up for lost revenue per case, so total sales growth for 2020 was essentially flat at minus 0.6 percent.

Profitability was surprisingly strong in 2020 due to staff reductions in customer-facing jobs from COVID, reduced harvest and winemaking costs from fires and smoke, and lower overhead allocations. In addition, many wineries availed themselves of Paycheck Protection Program loans in 2020, which were forgiven both in 2020 and 2021.

Like so much in the wine business, 2021 was the opposite of 2020 in terms of business conditions and results. As businesses and tasting rooms reopened, wineries were coming off a year with small crop sizes, so they stopped discounting and refocused on the tasting room and higher-end restaurants, which were restocking. More wineries moved toward seated tastings and reservations in 2021 and as a result, the average check per customer increased. Cases sold for the average winery decreased as part of a strategy by many to stretch out vintages to cover the short 2020 year.

Sales Behavior During Recessions

Ratios

Shoveling out Tanks

2021 brought a welcome reprieve for premium wineries after working through such a difficult 2020. Of course, sales growth rates of 21% aren't sustainable.

Post-recession history tells us the kind of growth we experienced in 2021 is more of a dead cat bounce related to the refilling of the supply chain rather than a sign of improving secular wine sales. No - the industry still has many issues to confront before we can expect sustainable success and dependable growth in the years ahead.

I won't repeat those challenges here. They were covered in the 2022 Annual State of the Industry report that you should review. Suffice it to say, the hurdles coming our way are large but solvable. They can largely be included within the topic of generational change.

To find success in the next decade, we will have to evolve the manner in which we sell and market wine. We have to include the values of the younger consumer who are more multi-cultural than the boomers who have driven wine sales growth since 1994. We have to make our wines reflect the industry's commitment to work toward a reduced carbon footprint, social equity, and sustainability. Health also plays a role in finding solutions, during an era when the WHO has all alcohol in its crosshairs.

The consumer is asking for products that are plant-based, sustainable, transparent as to source, made without chemicals, and with care for the environment, but our industry ignores those values and goes about marketing the same way we did 20 years ago.

Isn't it ironic that our wine is largely produced in a manner that already reflects the values young consumers seek in a product, but they don't know because we don't tell them!

The business, like all of life now, is churning faster and those changes will require a little bravery to face, and then solve. I also am convinced when presented with a clear challenge, the wine business will respond. To do that we will need to unite in some form to turn the current long-term trends.

Starting in late 2019 I started working alongside three other analysts who see precisely the same risks to the industry. We decided to begin a process to see if we could unify the industry to face these challenges. We call this initiative WineRAMP.

I encourage you to go to the WineRAMP.org website and sign up for updates on our progress for change. If for no other reason, please sign up to let us know you understand there is an issue!

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ 000 ~ ~ ~ ~ ~ ~ ~ ~ ~ ~