Monday, January 20, 2025

SVB State of the Wine Industry - what comes next?

Sunday, January 21, 2024

The 2024 SVB State of the Industry Report & replay is available for download

Nearly 3,000 attendees from dozens of the wine-producing countries of the world tuned in on January 18th to hear from Rob McMillan, EVP & Wine Division Founder, Crimson Wine Group CEO Jennifer Locke, industry innovator Paul Mabray, and Enolytics SVP of Professional Services Ed Thralls as they discussed the trends and findings identified in SVB’s 23rd annual State of the US Wine Report.

Watch the Replay: SVB State of the Wine Industry - 2024 Virtual Event (youtube.com)

Read the Report Here: State of the US Wine Industry Report 2024 | Silicon Valley Bank (svb.com)

Recognizing the Need for Change

The key findings indicate that the alcohol beverage market across the board is in a period of change, driven by evolving consumer dynamics, including the aging of older wine-focused boomers, who are being replaced by a new set of primary consumers who drink across categories, drink less wine, and consume less alcohol.

“With the current messaging about alcohol as it relates to health and wellness, premium wine is well suited to meet the prevailing guidance around benefits and moderation,” said Jennifer. “We don’t have to reinvent what we are making; we have to retell our story and tell it collectively.”

Premium wineries experienced mixed success during the past year. The value of premium wine is still growing, but we anticipate volume sales will finish lower this year. The industry will need to find collaborative solutions to link wine attributes with the segmented values of newer consumers to increase demand while at the same time finding efficiencies in sales, marketing, and production to retain margins.

Minor headwinds contributed to the mixed outcomes at premium wineries.

Direct-to-consumer volume sales were lower in 2023. Tasting room visitation dropped for the second straight year leading to lower premium sales through nine months in 2023. However, strong 2023 holiday sales should lead to positive growth in value at year-end.

Consumer demand for the total wine category continues to decline.

As reported over the last several years, in addition to wine, U.S. consumers have been drinking across categories such as ready-to-drink (RTD) options, spirits, beer, and cannabis or have been abstaining altogether.

There is an oversupply of planted vineyards, given current sales volumes.

Conditions are ripe for overproduction, which may lead to inventory excess in more price segments, discounting, and eventually price reductions. Pressure starting from the grower will create inventory bulges and drive higher-than-needed inventory turns in 2024.

Sunday, October 1, 2023

I Need Your Help with the 2024 State of the Industry Survey

It's been quite a roller coaster ride over the past six months. The banking industry has undergone many changes; my bank was no exception. Given our specific challenges, I didn't think this day would come again. So, I'm happy to report that we are today launching the 23rd annual State of the Wine Industry Survey. It is open now through October 22.

Wednesday, January 11, 2023

The 2023 SVB Annual State of the Industry Report will be released January 18th

Register here for the videocast, replay, presentation deck, and copy of this year's report.

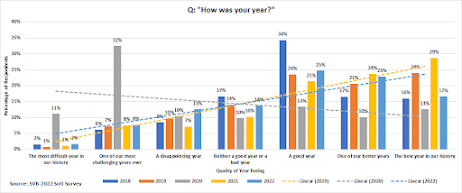

Within the 2022 SVB State of the Wine Industry Survey run last October, we asked how 2022 went and got the following response. (See headline slide)

Forty-percent of respondents said that the year was one of their better years or their best year ever. Fully sixty-five percent said it was a good year, and those results are very close to those from 2019 when we asked the same question.

Monday, January 18, 2021

Predicting Higher Demand for Wine in 2021.

The Case to be Made for a Party

On August 15th, 1945 with Japan's surrender and acceptance of the terms of the Potsdam Declaration, there was hope those unhappy times would soon be behind the country. The sacrifice of the Greatest Generation had paid off and the men and women in the military would soon be coming home! Life would eventually return to an altered normal - but a much better one full of peace and hopefulness.

As the soldiers were brought home starting in 1945 with those in the European Theatre under Operation Magic Carpet, a rolling party broke out on the homefront. It is estimated that 1946 consumption of alcohol reached pre-prohibition levels of 2 liters per capita. Wine became a beverage of interest for many of the returning service members who had experienced European wine.

Sunday, January 10, 2021

SVB Annual State of the Industry Report and Videocast is Wednesday. Sign up!

We're All Glad that Year is Over

2020 will go down as the year in which we answered the heretofore rhetorical question - What else can go wrong? That is the opening line from the 2021 SVB State of the Industry Report that will come out Wednesday the 13th.

Throughout 2020 many of us experienced the same run of emotions from disbelief, fear, acceptance, determination, and occasionally even a bit of joy through one of the most difficult times in history. As we went through the year, we would think to ourselves - this has to be the worst of it. It has to get better from here?

We all fought through a series of events, increasing our vocabulary along the way: Coronavirus, COVID, S.I.P. Orders, social distancing, Zoom meetings, herd immunity, PPE, and pandemic - which I thought only happened in bad science fiction movies before last March.

Will 2021 Be Better than 2020?

We need information and the right tools to be able to plan. While we have to talk about the past for context, this coming Wednesday, I hope to give everyone the benefit of a look forward.

Start with the headline slide for a teaser. Despite the gloomy events of the past year, luxury wine sales held their own, particularly when you consider this performance in context with the last recession. The last recession featured trading down. This recession has given a breath of life to trading up again! Aren't you curious why?

Sunday, January 6, 2019

Cannabis & Millennial Wine Consumption

Following the 2012 initiatives in Colorado and Washington that legalized the recreational use of marijuana, questions started to be asked around the wine business about the substitution effect of pot and wine. Even more interesting to me is to think through, why the wine industry would even ask the question?

The reason the question is being asked is everyone in the wine industry has been feeling uncomfortable with sales trends for some time, and we are all trying to pin down the root causes for the changes. Many have already concluded cannabis is hurting wine sales.

While I've avoided talking about cannabis in the Annual SVB State of the Industry Report up to this point, this year because of the trends I'm seeing, I felt it necessary to take this subject head-on.

You can sign up [here] to receive a link to the 2019 SVB Wine Industry Report and the live videocast which will take place on January 16th this year. But here are some of the thoughts I'll present on wine and weed within the report this year.

Friday, September 28, 2018

The Annual SVB Wine Business Survey

Those are the questions business owners should be asking today because change creates both opportunities and threats. So we need to understand what's happening in measurable ways. We all need to know exactly what's transpiring, but how are you going to get that business intelligence?

Story of My Life

I've always been frustrated by the lack of actionable information and the availability of street-level intelligence in the wine business. There was plenty of information on wine-making and grape growing, but there was never satisfying business intelligence available. What is really happening? How can I know if a decision is sound without any reference points?

With no good information available, more than 15 years ago I started doing annual research just to make sure the wine community had a starting point. There is a lot to talk about today:

- What are emerging trends in Direct to Consumer sales?

- Is there any pricing upside available in my price segment?

- Will M&A continue and if so, what are buyers seeking?

- What growth rate can I anticipate next year?

- Where should I look for new consumers?

- Are imports or cannabis going to cut into sales?

- Will grape prices increase next year?